Stop searching. Start filing.

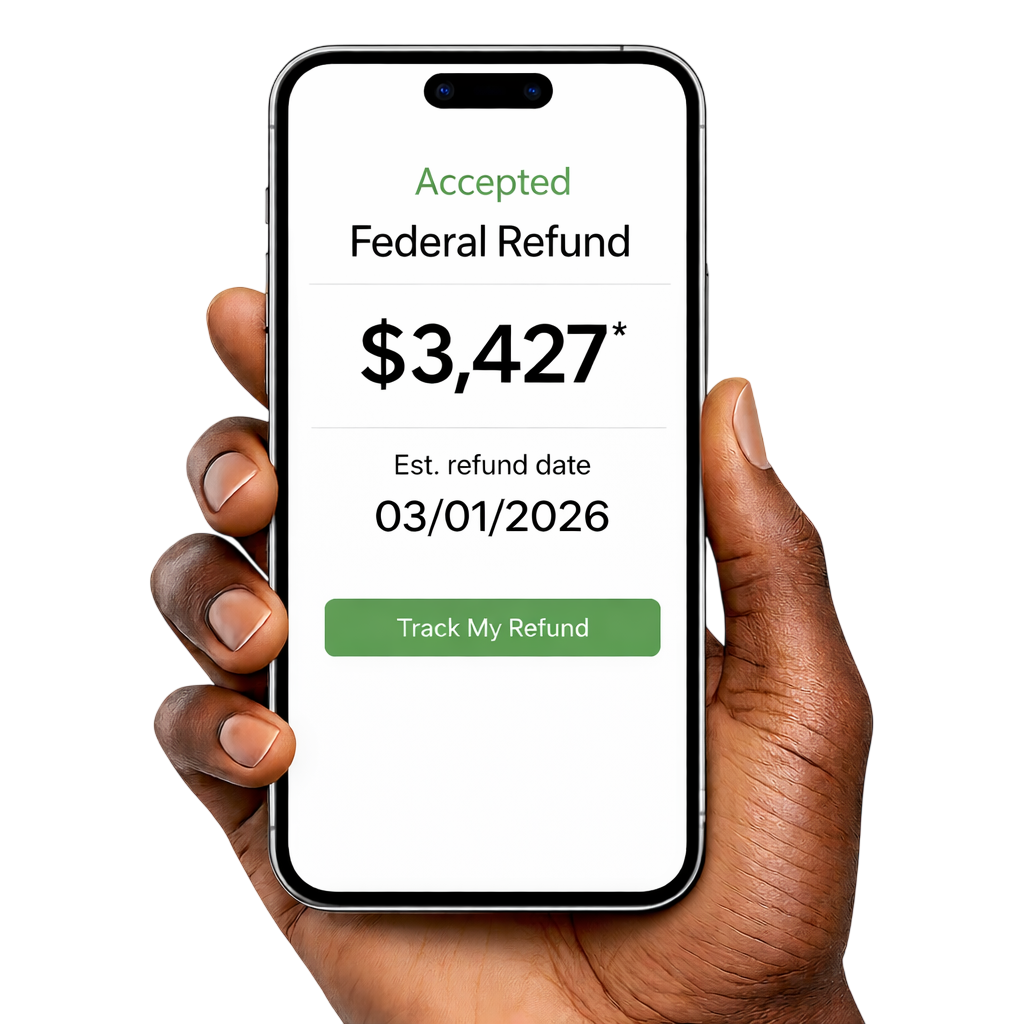

FREE Tax Refund Estimate

“If your filing was rejected, we can help you review and correct it.”

Stop searching. Start filing.

“If your filing was rejected, we can help you review and correct it.”

We help taxpayers overcome the filing marathon and move forward—quickly, clearly, and correctly.

Tax season doesn't need to be complicated.

"Streamline taxes perfectly. Find deductions you may not notice!"

Our pricing is competitive and based on the complexity of your tax situation. We believe in transparent, upfront pricing—no hidden fees. To receive an accurate quote, contact us directly or schedule a consultation.

Most clients will need W-2s, 1099s, last year’s tax return, a valid ID, and documentation for income, deductions, or credits. Additional records may be required depending on your situation. For a complete checklist, visit our website or contact our office.

Yes. We provide expert business tax services for sole proprietors, partnerships, LLCs, S-Corporations, and C-Corporations. Our team assists with tax planning, compliance, and filing to help keep your business in good standing with the IRS.

Your privacy and security are our top priorities. We use secure, encrypted systems for data storage and transmission and follow strict confidentiality protocols to protect your personal and financial information.

We offer a full range of tax services, including individual and business tax preparation, self-employment taxes, tax planning, return amendments, and more. We work with freelancers, small business owners, and larger organizations alike.

Scheduling is easy. You can call us at 880-500-1111.

Turnaround time depends on the complexity of your return.

Call to file with a pro.

Tax Pivot offers professional tax preparation and filing services designed to support compliant, accurate, and organized tax filings for individuals and small businesses.

Professional preparation of federal and state individual tax returns. We help ensure accurate reporting, proper documentation, and compliance with current tax laws based on your unique situation.

Support for freelancers, contractors, and sole proprietors. We assist with income reporting, business expenses, and deductions relevant to self-employed individuals.

Tax preparation support for small businesses, including partnerships and corporations. Our process focuses on organized filings, compliance requirements, and clear documentation.

Secure electronic filing of tax returns using IRS-compliant systems. E-filing helps reduce errors, improves processing speed, and provides confirmation once submitted.

Assistance with correcting previously filed tax returns. We help update information, resolve filing errors, and submit amended returns when changes are needed.

Ongoing assistance throughout the tax filing process. We help answer questions, explain requirements, and guide you from document submission through filing completion.

Ongoing bookkeeping support to help track income, expenses, and financial activity. We assist with maintaining organized records to support accurate reporting and informed business decisions.

Accounting assistance for small businesses focused on record accuracy and financial clarity. Our support helps ensure financial information is properly maintained throughout the year.

Tax Pivot is a privately owned tax preparation and filing assistance service and is not affiliated with, endorsed by, authorized by, or connected to the Internal Revenue Service (IRS), any state tax authority, or any government agency. References to federal or state tax refunds are for informational purposes only.

Tax preparation services are provided based solely on the information supplied by the taxpayer. Taxpayers remain fully responsible for the accuracy, completeness, and truthfulness of all information submitted, as well as for any final tax returns filed.

Refund amounts, processing times, and tax outcomes vary by individual circumstances and are not guaranteed. Any statements regarding maximizing refunds, reducing tax liability, or identifying deductions represent potential outcomes only and should not be interpreted as guarantees.

Services may be performed by tax professionals including Enrolled Agents (EAs), Certified Public Accountants (CPAs), or other qualified tax preparers, depending on availability, location, and the complexity of the tax return. No representation is made that a specific credentialed professional will be assigned unless explicitly stated.

Tax Pivot does not provide legal advice, financial planning advice, investment advice, or audit defense services unless expressly contracted in writing. Users should consult appropriate professionals for advice specific to their situation.

Fees for tax preparation and related services vary based on tax complexity and services selected. All applicable fees are disclosed prior to filing. Payment options may include upfront payment or deduction from refund, where permitted by law. No refund or fee outcome is guaranteed.

Tax Pivot employs commercially reasonable, industry-standard security measures to safeguard user information; however, no electronic transmission or storage method can be guaranteed 100% secure. Users acknowledge and accept inherent risks associated with online data transmission. See our Privacy Policy for additional details.

Availability of services may vary by state. Certain features, services, or filing options may not be available in all jurisdictions.

Use of this website or services constitutes acceptance of our Terms of Service and Privacy Policy.

123 West North Street, Palm Coast, Fl 32164